Contents

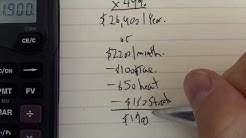

How Much Home can I Afford? How We Calculate it.. The average American household income is $73,298, assuming you have no monthly debt payments you can afford a home priced at $285,000 with a 3.5% ($10,000) down payment for $1,800 per month.

What House Price Range Can I Afford · Your annual income isn’t always the best number to derive the price of a home you can afford. Look at total debt obligations too.. of your monthly income.A range of.

VA Home Loan Affordability Calculator. Estimate your loan pre-approval amount based on your income and expenses. With the current information: a home price of $252,351 makes monthly payment $1,571 with Left Over $1,007. This price may be risky. This price may be challenging to afford.

Affordability Calculator. Find an estimate of how much mortgage or rent you can afford.

Guide To Buying A House In other words, buying their kid a house in London is even hurting bouji middle and upper middle class parents. Another bit of proof that home ownership is no longer possible through hard work. All in.

A mortgage, or mortgage loan, is a loan that uses the property or real estate as collateral for the loan.. Mortgage- How Much Can I Afford?

The usual rule of thumb is that you can afford a mortgage two to 2.5 times your annual income. That's a $120,000 to $150,000 mortgage at.

How much mortgage can I afford? Your income, credit history , the size of your down payment , and your employment and residence history are all factors in how much you could borrow. Depending on circumstances, the amount you could borrow may exceed the amount you can comfortably afford – so it pays to borrow cautiously.

As interest rates rise, homebuyers are discovering that they can’t afford as much home as they could have just a few years ago. The 30-year mortgage rate recently stood at about 4.6%, according to a.

The home affordability calculator from realtor.com helps you estimate how much house you can afford. Quickly find the maximum home price within your price range.. and a mortgage with payment.

Where Do I Start When Buying A House Step 5: Shop for Your Home and Make an Offer. Then work with your real estate agent to negotiate a fair offer based on the value of comparable homes in the same neighborhood. Once you and the seller have reached agreement on a price, the house will go into escrow, which is the period of time it takes to complete all of the remaining steps in the home buying process.

To determine how much house you can afford, use this home affordability calculator to get an estimate of the property price you can afford based upon your income and debt profile. Generally, lenders cap the maximum monthly housing allowance (including taxes and insurance) to lesser of Front End Ratio (28% usually) and Back End Ratio (36% usually).

How To Start The Home Buying Process Start The Home buying process. start The Home buying process. skip navigation Sign in. search. loading. close. This video is unavailable. watch queue queue. watch Queue Queue.

The mortgage calculator will help you determine how much home you can afford and what your monthly payments will look like. The mortgage calculator will help you determine how much home you can afford and what your monthly payments will look like.. Home Affordability Calculator.

The mortgage calculator will help you determine how much home you can afford and what your monthly payments will look like. The mortgage calculator will help you determine how much home you can afford and what your monthly payments will look like.. Home Affordability Calculator.